In the very complex world of corporate governance, a Certificate of Incumbency stands as a vital document that attests to the identities of a company’s key officers and directors. It is of utmost importance when undertaking such activities as international transactions, establishing bank accounts for corporations, and ensuring compliance during mergers. This document is vital in almost everything and stands for trust and transparency. Many businesses, however, struggle to formulate accurate, legally sound certificates as a result of outdated templates and a lack of understanding regarding the modern requirements for creating such documents.

In this post, we are going to introduce two groundbreaking concepts—Incumbency Precision Framework (IPF) and Dynamic Officer Verification Matrix (DOVM)—to revolutionize how businesses approach Certificate of Incumbency templates.

Understanding the Certificate of Incumbency

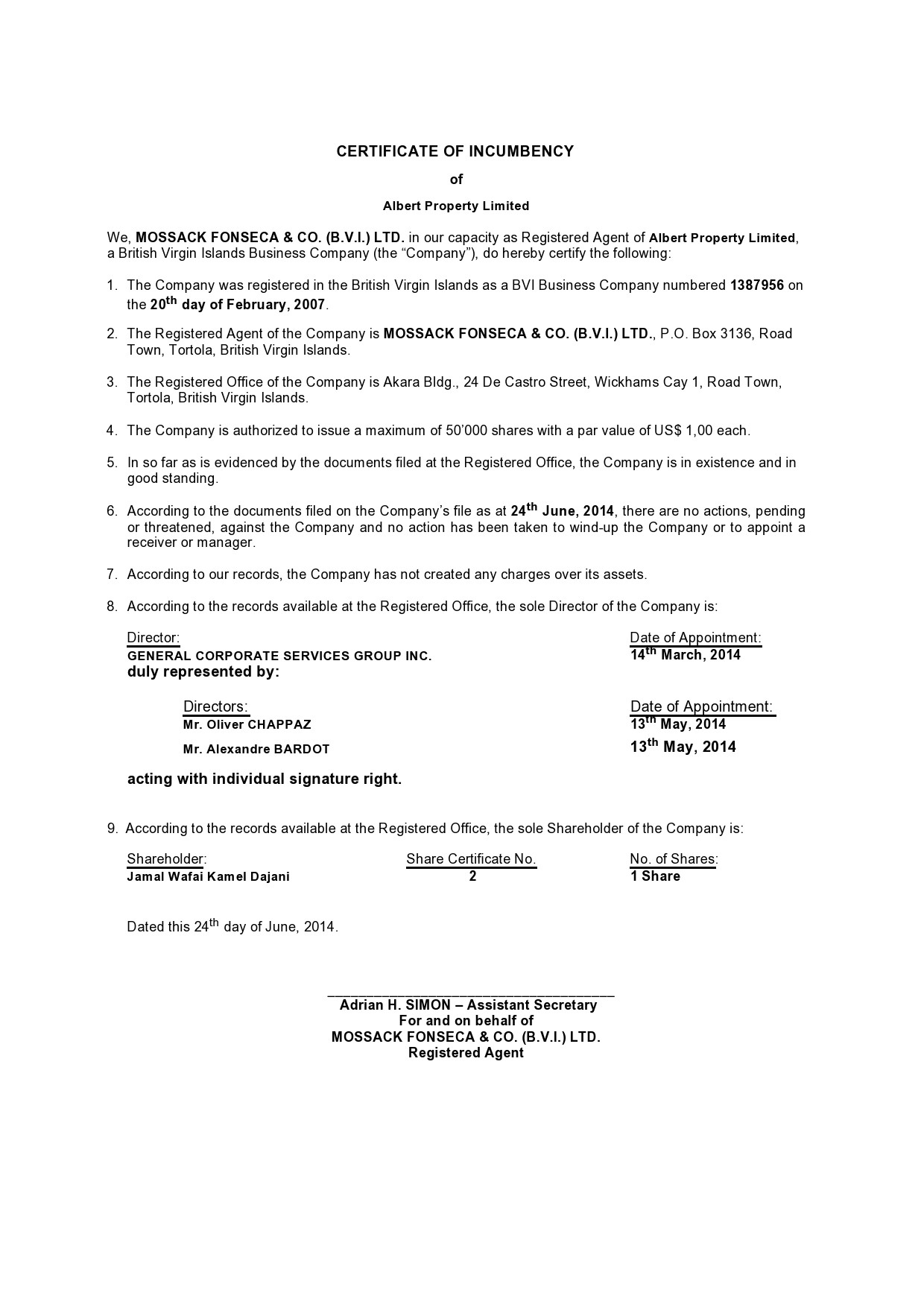

A Certificate of Incumbency is a formal document that is typically issued by a company or its legal representative to confirm the identity and capacity of a company’s current officers, directors, and, occasionally, shareholders. This document is mostly demanded in international commercial transactions as proof of the authority of those who act for the company. This certificate differs from articles of incorporation in that the latter creates the existence of the company, while this certificate focuses on the people currently occupying vital positions.

Why It Matters

Cross-border transactions, for example, opening a foreign bank account or entering a contract in another country, usually give rise to requests for a Certificate of Incumbency. Without a specific pre-standardized reliable template, companies may face delays, legal disputes, and or rejection by banks or by regulatory bodies. Accuracy is vital for this document as an erroneous record would destroy confidence or bring along expensive compliance issues.

The Gaps in Current Certificate of Incumbency Templates

Online templates for certificates of incumbency are mostly standardized and generic; not applicable for any specific industry or jurisdiction. They do not, for example, account for some modern-day regulatory requirements, that is, anti-money laundering (AML) compliance or digital notarization standards. Most resources do not take scalability into consideration-most templates may work for small businesses, but this might not be the case with multinational corporations, where governance structures tend to be far more complicated. Such lacunae breed inefficiency and expose the companies to risks.

The Need for Innovation

To address these shortcomings, this article introduces two novel frameworks: the Incumbency Precision Framework (IPF) and the Dynamic Officer Verification Matrix (DOVM). These concepts offer structured, adaptable approaches to creating Certificates of Incumbency that meet diverse business needs while ensuring compliance and clarity.

Introducing the Incumbency Precision Framework (IPF)

The Incumbency Precision Framework (IPF) is a structured methodology for designing Certificate of Incumbency templates that prioritize accuracy, regulatory compliance, and adaptability. Unlike static templates, IPF emphasizes a modular approach, allowing businesses to tailor certificates to specific jurisdictions, industries, or transaction types.

Key Components of IPF

The IPF has three basic tenets which are Clarity, Conformity and Customization. Clarity is meant to ensure that all stakeholders from bankers to legal authorities can easily understand the document. Compliance brings into the document jurisdiction specific requirements such as notarization or apostille certification. Customization allows the companies to change the template according to their unique governance structures-whether startups or global enterprises.

Why IPF is a Game-Changer

Traditional templates utilize generic language, which may fail to take into account particular legal or operational nuances. For instance, a small California-based tech company might need only a simple presentational certificate for its local bank, while a multinational corporation in Singapore involved with cross-border mergers will require a very detailed document. Modular design within IPF ensures that companies can craft specific, contextually relevant certificates without ever having to start from a blank page. This will save them time, reduce opportunities for mistakes, and build confidence with outside parties.

Practical Application of IPF

Consider a hypothetical scenario: a U.S.-based fintech company expanding into the European Union. Using IPF, the company crafts a Certificate of Incumbency that includes EU-specific compliance details, such as GDPR-related officer disclosures, while maintaining a clear format for local regulators. By following IPF’s modular structure, the company avoids delays in opening a European bank account, demonstrating the framework’s real-world impact.

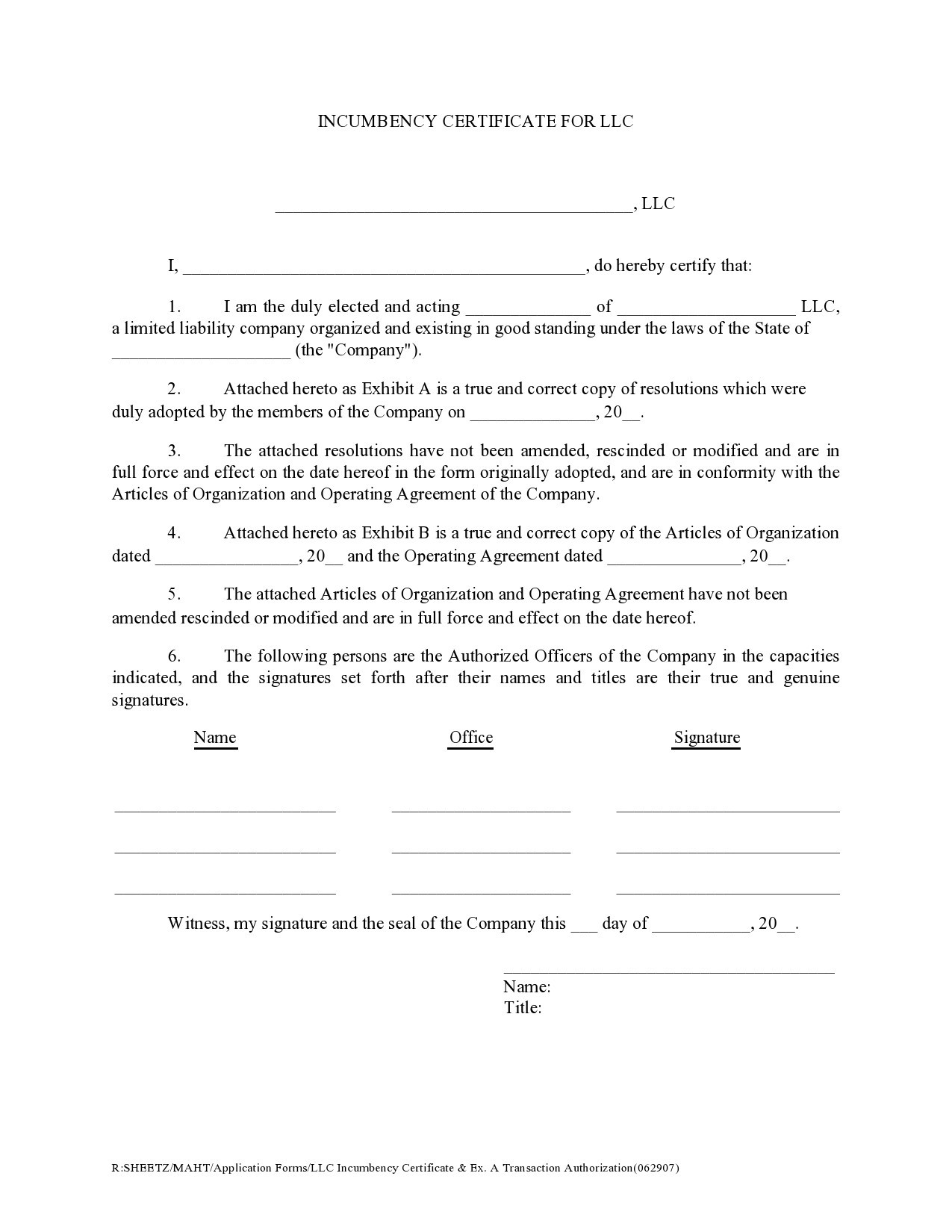

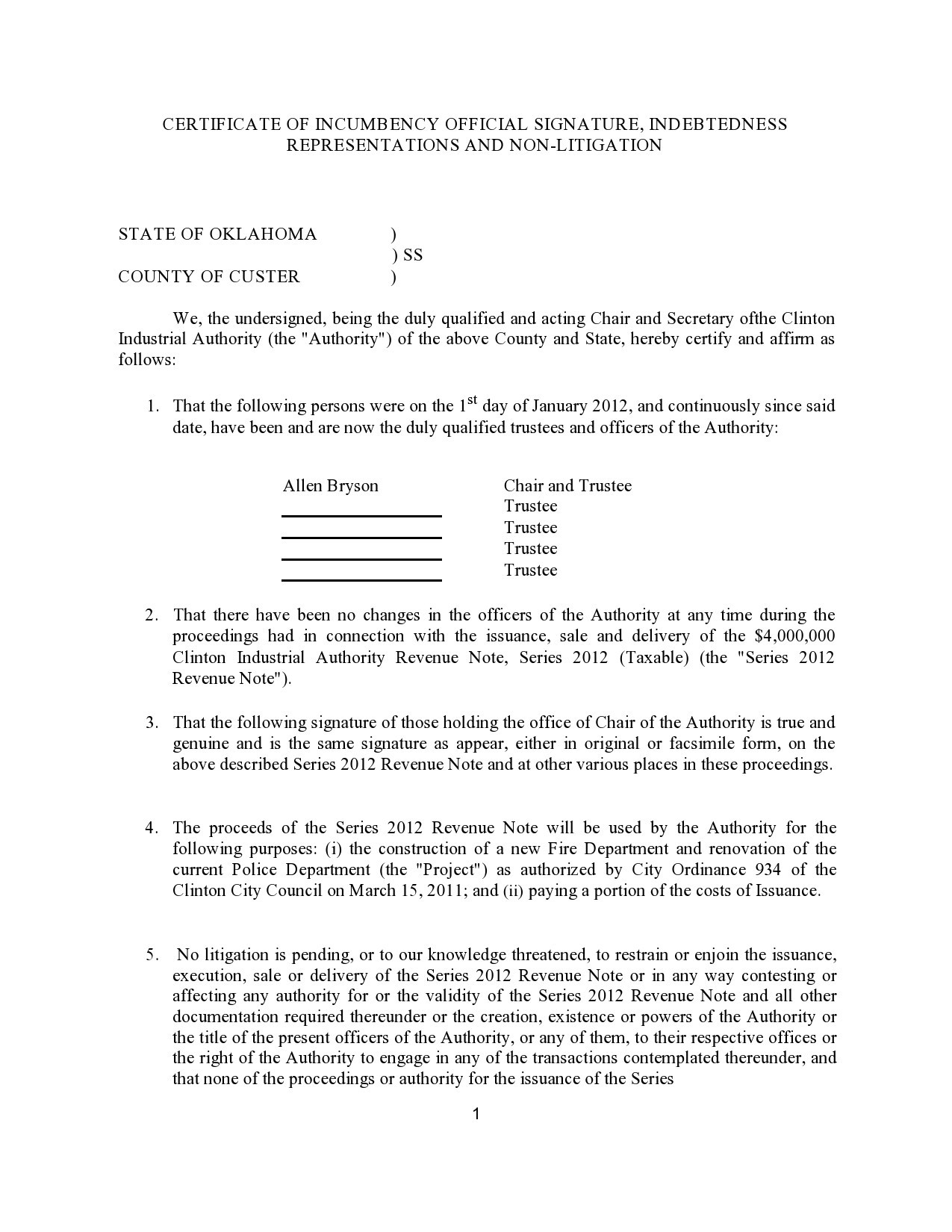

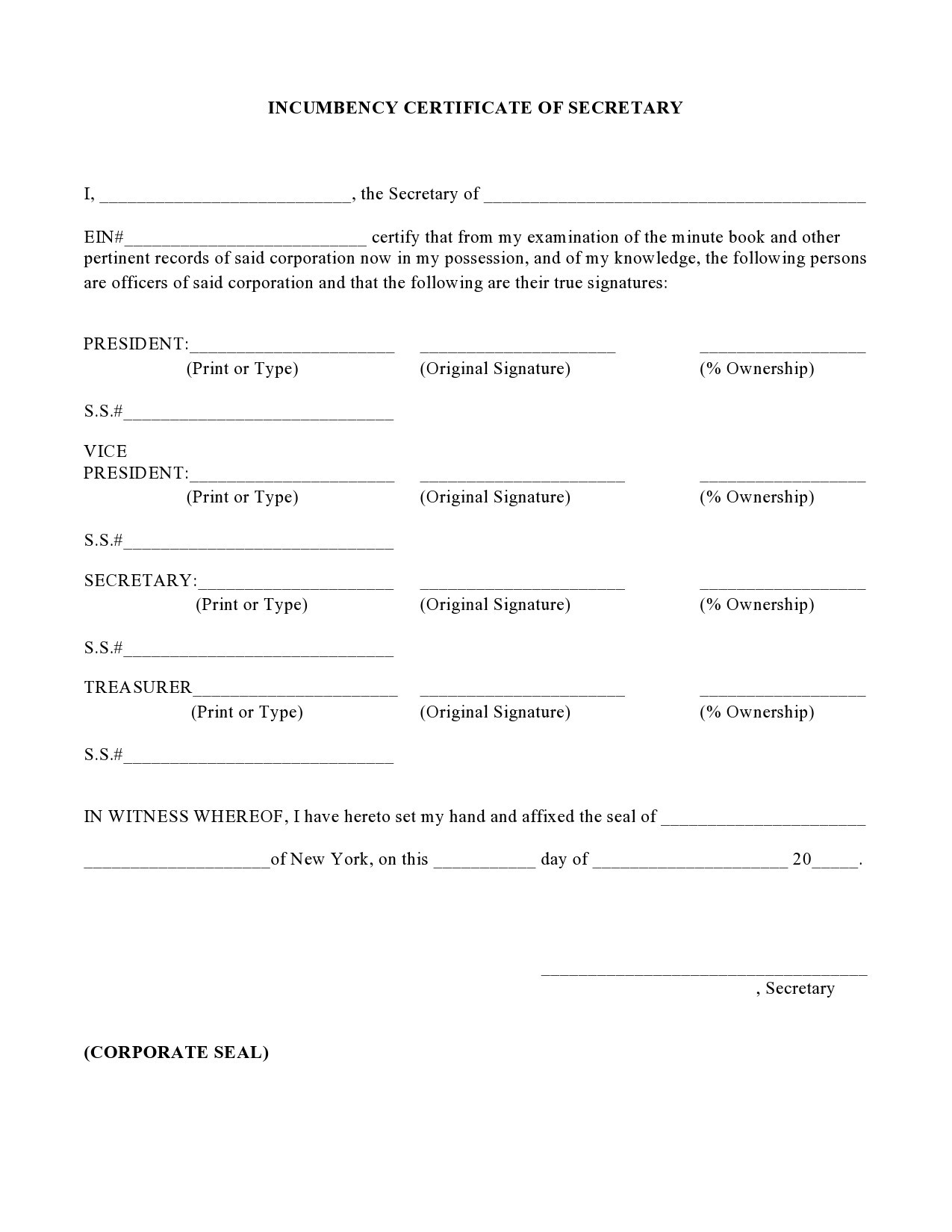

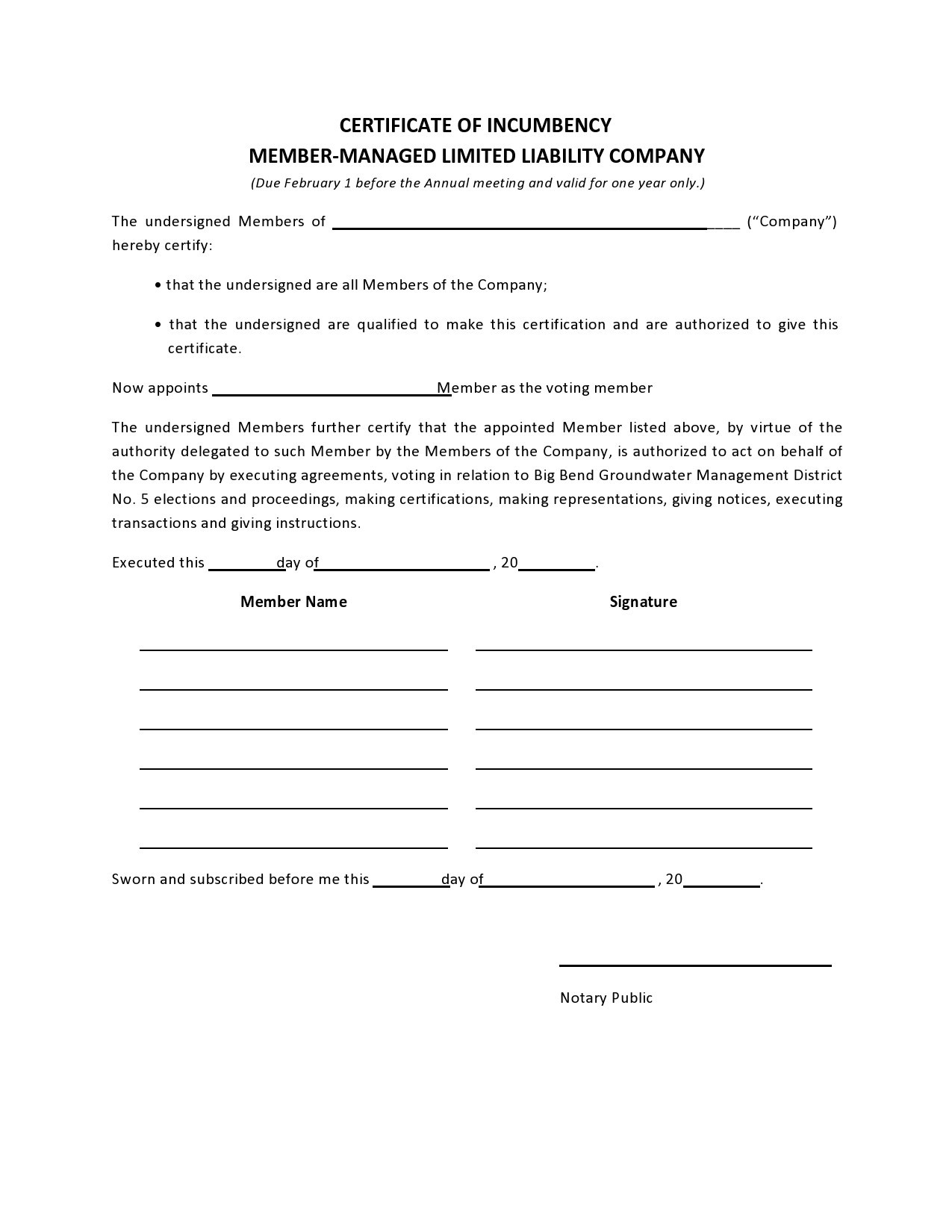

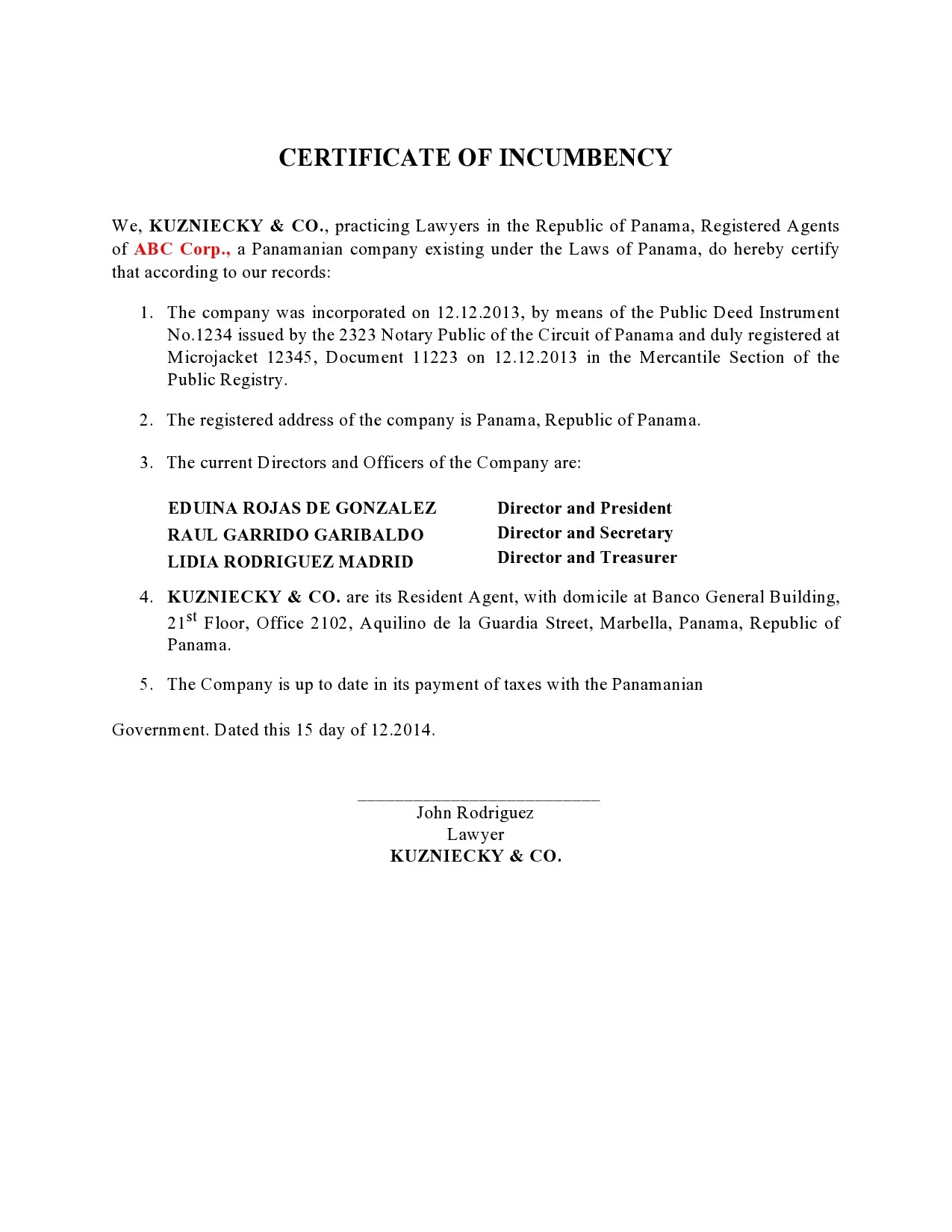

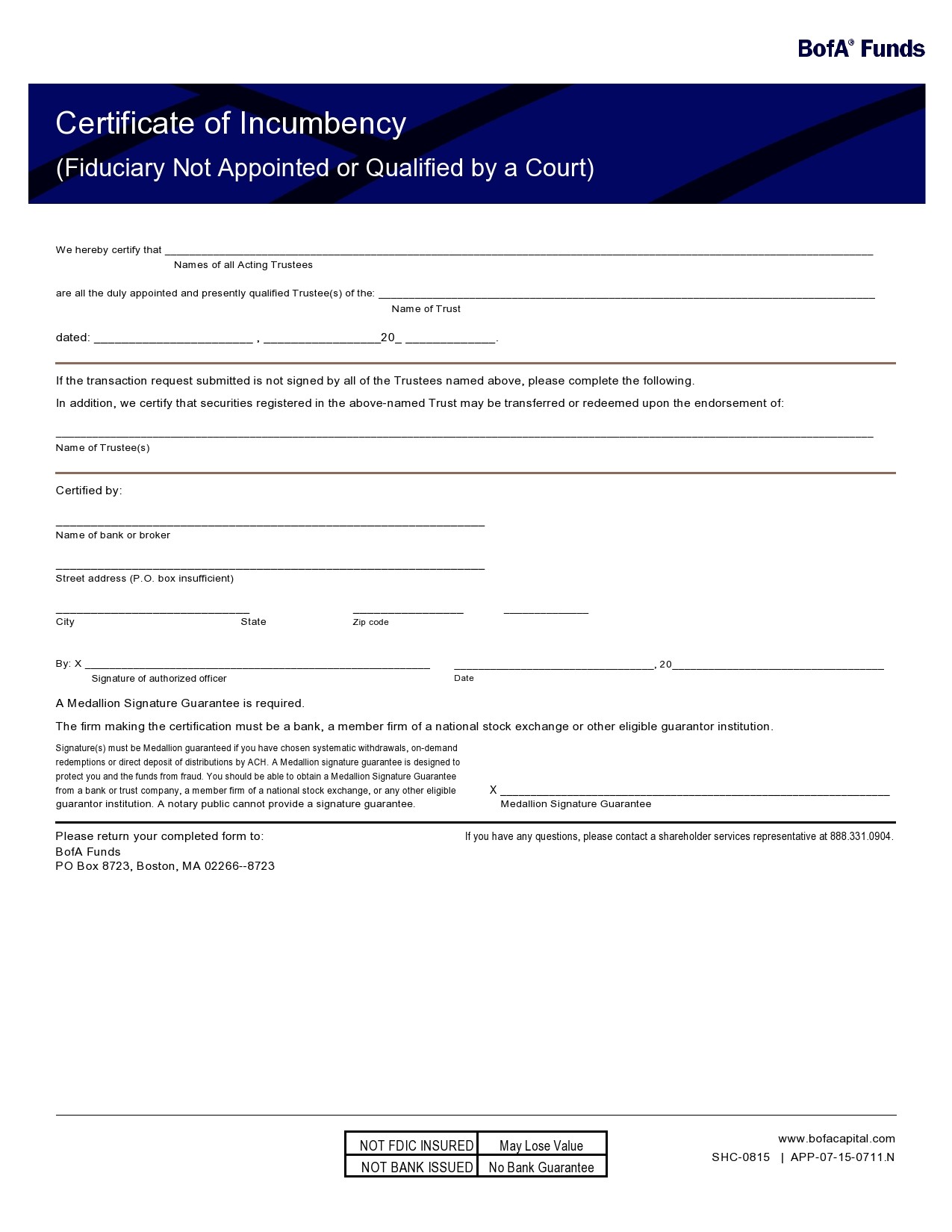

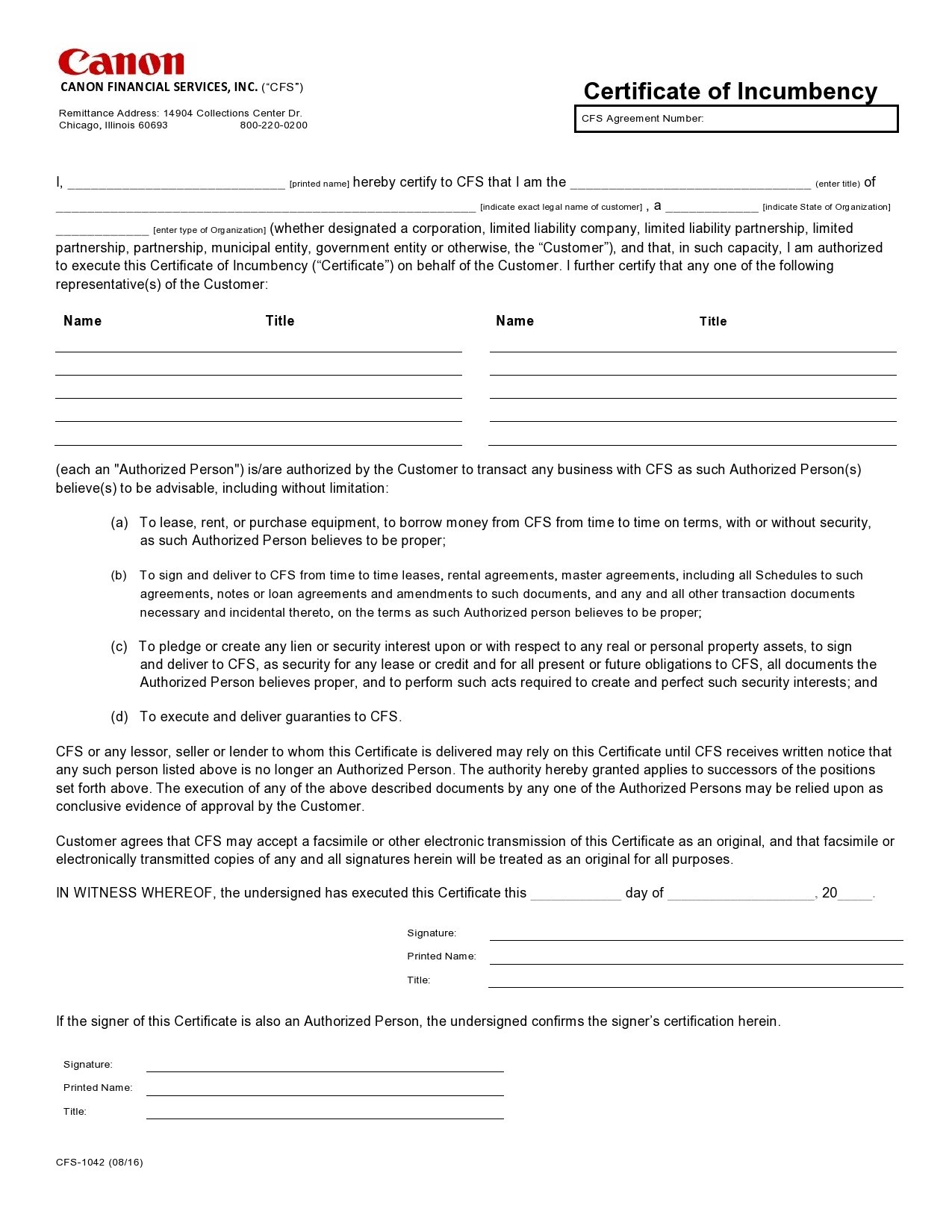

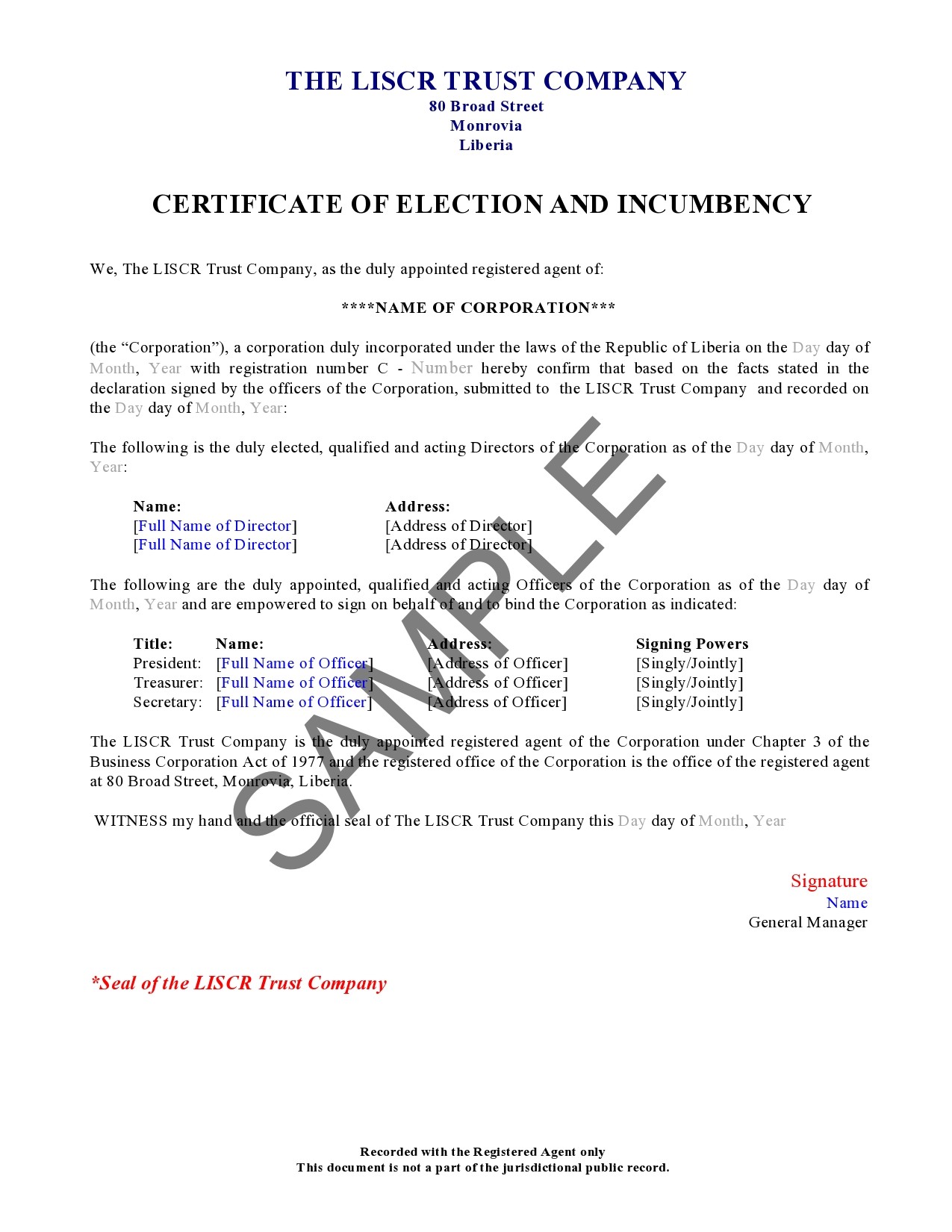

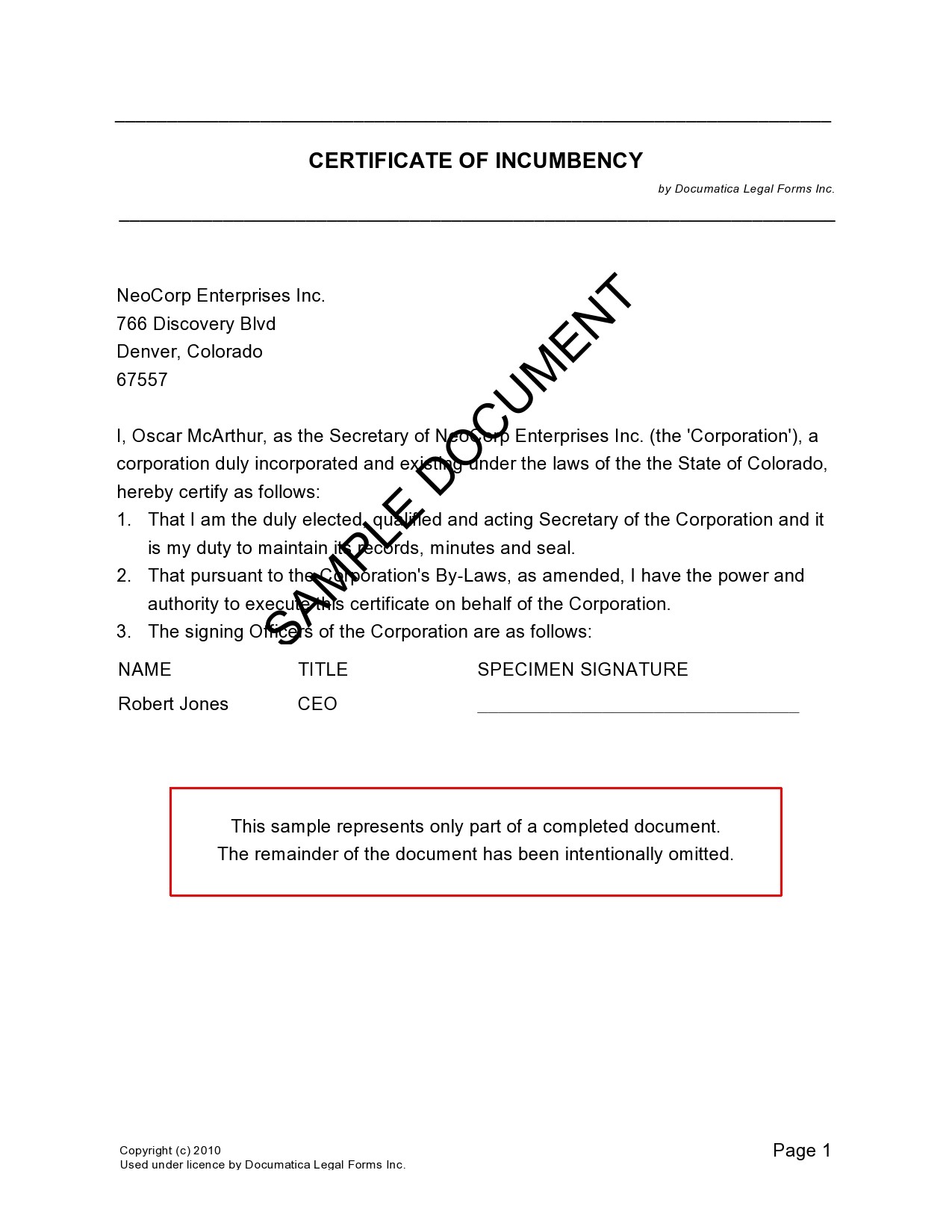

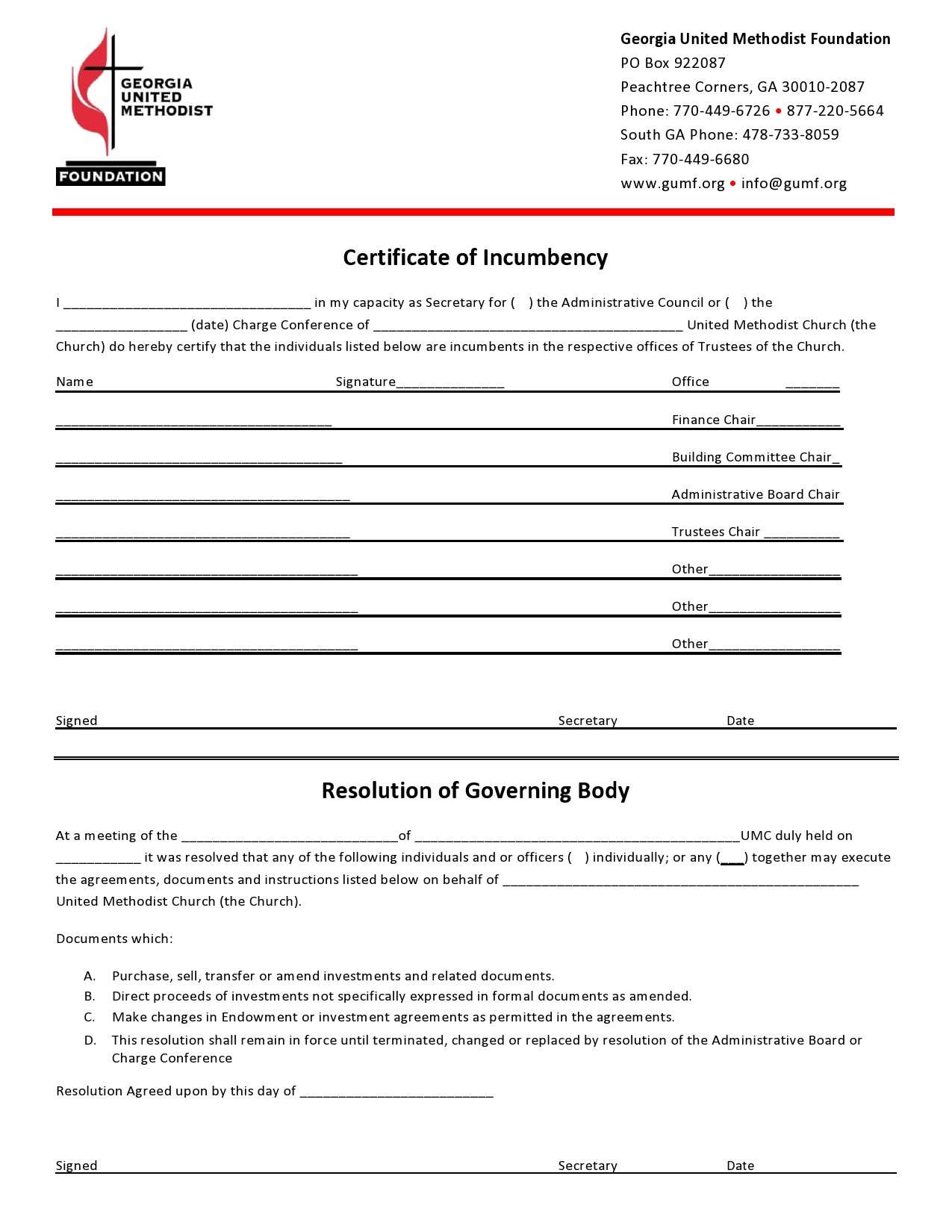

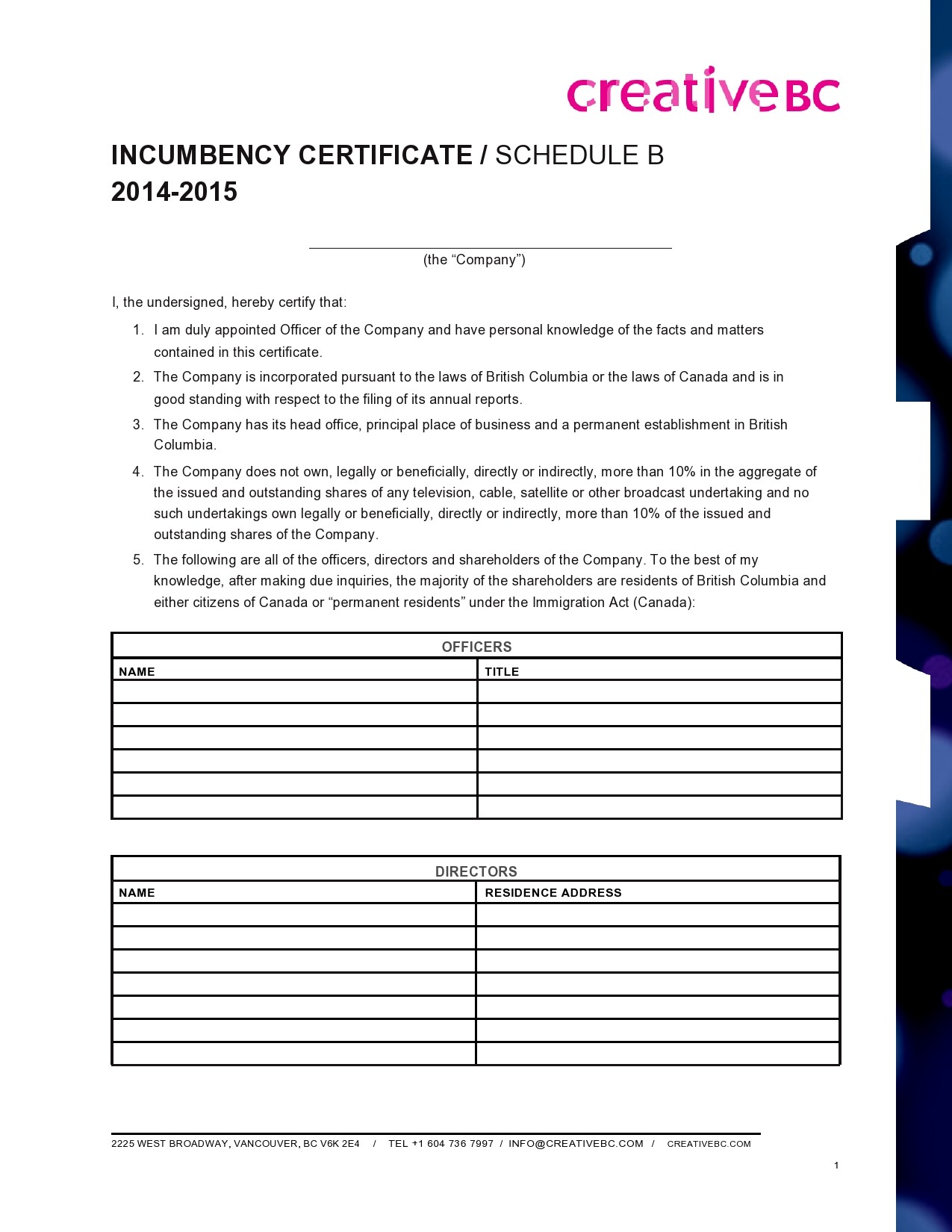

Here are previews and download links for these free Templates using MS Office Suit of Applications.

The Dynamic Officer Verification Matrix (DOVM)

The Dynamic Officer Verification Matrix (DOVM) is a complementary tool to IPF, designed to streamline the process of verifying and updating officer information in Certificates of Incumbency. DOVM is a digital, database-driven framework that tracks officer roles, tenure, and authority in real time, ensuring that certificates reflect the most current data.

How DOVM Works

DOVM acts as an integrated central repository for officers’ data with all the relevant corporate governance systems. He continues to update details like resignations, appointments and changes in authority to minimize the hazards of having out-of-date certificates. The matrix also includes verification checkpoints like cross-referencing officer identities with government databases or corporate filings to ensure accuracy.

Advantages Over Traditional Methods

Certificates of Incumbency are manually updated and thus a tedious process fraught with errors especially for larger organizations with varied leadership changes. DOVM mitigates such an issue by automating the whole process, ensuring that certificates are always up-to-date and compliant with standards. For example, a corporation with subsidiaries in very many countries could use DOVM to generate region-specific certificates at the press of a button to avoid discrepancies at the time of audits or transactions.

Real-World Example

Imagine a global retail chain undergoing a leadership transition. Using DOVM, the company’s legal team accesses a real-time dashboard showing the current board of directors and officers across all subsidiaries. When a European bank requests a Certificate of Incumbency, the team generates a compliant document in minutes, complete with notarization details and officer verification records. This efficiency enhances the company’s reputation and operational agility.

How to Create a Certificate of Incumbency Using IPF and DOVM?

Crafting a Certificate of Incumbency with IPF and DOVM involves a systematic process that ensures accuracy and compliance. Below is a detailed guide to creating a robust certificate.

Step 1: Define the Purpose and Jurisdiction

Get to the point about what the certificate is for – whether it is for banks, mergers, or regulatory filings – and then what the jurisdiction is. For instance, if a certificate for a UK bank, there must be some particular phrasing required under the Companies Act 2006. The part of customization by IPF ensures that the template fits the requirements.

Step 2: Gather Officer Information Using DOVM

Obtain DOVM and compile all valid latest information about officers and directors. The line cross-relates such data with corporate records to ensure any mismatches. For example, last week if an officer resigned, then DOVM would indicate the change problems that might lead to incorrect information.

Step 3: Structure the Document with IPF

Using the modular structure of the IPF, create a certificate with sections for the names of the officers, their titles, dates of appointment, and the stipulations for their authorization. Maintain clarity and conciseness and attach appropriate notarization or apostille sections if any.

Step 4: Review and Notarize

Before concluding, confirm the certificate’s accuracy and compliance with local laws. If needed, notarization or apostille may be done for international purposes. This procedure is operated under the compliance pillar of IPF, which safeguards the fulfillment of all legal requirements.

Step 5: Distribute and Archive

Disseminate the certificate to all interested parties, including banks or regulators, and store it in DOVM for future reference. Consequently, updates or audits can be comfortably facilitated.